japan corporate tax rate 2018

The worldwide average statutory corporate income tax rate measured across 180 jurisdictions is 2354 percent. Measures to transition from the current consolidated tax.

日本 企业所得税税率 1993 2021 数据 2022 2024 预测

Dividends received for years beginning between 1 April 2016 and 31 March 2018 will be subject to the old rules ie.

. This page provides - Japan Corporate Tax Rate - actual values historical data forecast chart statistics economic. The new regime will be effective for tax years beginning on or after 1 April 2022. Learn the essentials of Japans corporate tax rates and your obligations as an employer in Japan with Links International.

The corporation tax rate unlike progressive income tax is determined by the type and size of the corporation. Japan - Corporate - Taxes on corporate incomeThe corporation tax rates are provided in the table below effective from tax years beginning on or after 1 April 2016 and 1 April 2018. In the case that a corporation voluntarily files the tax return after the due date this penalty may be reduced to 5.

The Corporation Tax Rate in Japan. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an all time high of 5240 percent in 1994 and a record low of 3062 percent in 2019. Note that the definition of capital surplus was amended by the 2020 Tax Reform Act from the tax law purpose to.

If the tax return is filed late a late filing penalty is imposed at 15 to 20 of the tax balance due. For a company with capital of 100 million or less a lower. Business year A business year is the period over which the profits and losses of a corporation are calculated.

Japan Corporate Tax Rate was 3062 in 2022. Since then countries have realized the negative impact corporate taxes have on business investment. The WHT for dividends is applicable at a rate of 15 national tax and 5 local.

The tax rate for corporations other than SMEs is 234. And 31 March 2018 Tax rates for companies with stated capital of JPY 100 million or greater are as follows. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020.

An under-payment penalty is imposed at 10 to 15. The business year is stipulated by the companys articles of incorporation. Tax rates The tax rate is 232.

In 1980 corporate tax rates around the world averaged 4663 percent and 3884 percent when weighted by GDP. Corporation tax national Local corporate Tax. After April 1 2019.

Taxation in Japan Preface. Under the 2020 Tax Reform Act the currently effective consolidated tax regime would be abolished and replaced with a new regime of group relief group tax relief. Corporate - Group taxation.

Japan corporate tax rate 2018. 0375 of capital plus capital surplus 625 of income x 12. Central government tax 3 190 255 255.

The contents reflect the information available up to 20 October. 232 for the fiscal year starting after April 2018. Detailed description of income determination for corporate income tax purposes in Japan Worldwide Tax Summaries.

Asia has the lowest regional average rate at 1962 percent while Africa has the highest regional average statutory rate at 2797 percent. Now in 2018 the average corporate tax rate is 2647 percent and 2303 when weighted by GDP. Donation made to designated public purpose companies.

Japan Tax Profile Produced in conjunction with the KPMG Asia Pacific Tax Centre Updated. Corporate income tax rate exclusive of. Historical Chart by governors Haruhiko Kuroda.

Special local corporate tax rate is 4142 percent which is imposed on taxable income multiplied by the standard of. 2018 the corporate tax rate was changed from a tiered structure that staggered corporate tax rates based on company income to a flat rate of 21 for all companies. Company size and income Corporate tax rates table - KPMG Global - KPMG InternationalKPMGs corporate tax table provides a view of corporate tax rates around the.

025 of capital plus capital surplus 25 of income x 14. A major feature of corporation tax is the tax rate. The average top corporate rate among EU.

Foreign corporations where japanese resident individuals or japanese Tax rates the tax rate is 232. The rate is increased to 10 to 15 once the tax audit notice is received. Taxable income 4 mln 8 mln 4 mln 8 mln.

When weighted by GDP the average statutory rate is 2544 percent. Statutory Corporate Income Tax Rate in Japan as of April 2014 1. This booklet is intended to provide a general overview of the taxation system in Japan.

Corporate income tax. Income from sources in Japan during each business year. Starting a business in Japan.

The main types of corporate income tax in Japan are as follows. Still eligible for exclusion. A 19 corporate tax rate is applied for companies which had average incomes larger than 15 billion JPY in the preceding 3 years.

Real Estate Related Taxes And Fees In Japan

Individual Income Tax Return Filing In Japan For Foreigners Latest 2021 2022 Shimada Associates

New Zealand Tax Income Taxes In New Zealand Tax Foundation

Corporate Tax Reform In The Wake Of The Pandemic Itep

Japan Tax Income Taxes In Japan Tax Foundation

Doing Business In The United States Federal Tax Issues Pwc

Japan National Tax Revenue Statista

North Carolina Ranks Third Nationwide In Competitive Corporate Income Taxes Economic Development Partnership Of North Carolina

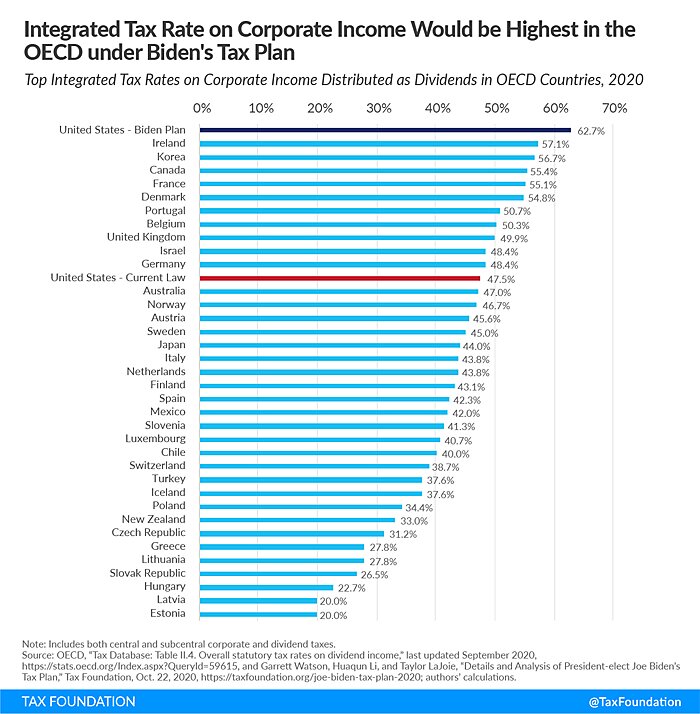

House Democrats Tax On Corporate Income Third Highest In Oecd

Taxing Corporations Might Be Good Politics But It S Still Bad Policy Cato Institute

Capital Gains Tax Japan Property Central

Corporate Tax Reform In The Wake Of The Pandemic Itep

Korea Tax Income Taxes In Korea Tax Foundation

Lithuania Corporate Tax Rate 2022 Data 2023 Forecast 2006 2021 Historical

New Zealand Tax Income Taxes In New Zealand Tax Foundation

Corporation Tax Europe 2021 Statista

Latvia Tax Income Taxes In Latvia Tax Foundation

Real Estate Related Taxes And Fees In Japan

Israel Corporate Tax Rate 2022 Data 2023 Forecast 2000 2021 Historical Chart